amazon flex taxes canada

We are actively recruiting in. The SE tax is already included in your tax due or reduced your refund.

Amazonflex Amazon Flex Canada Pros Youtube

Pickups from local stores in blocks of 2 to 4 hours.

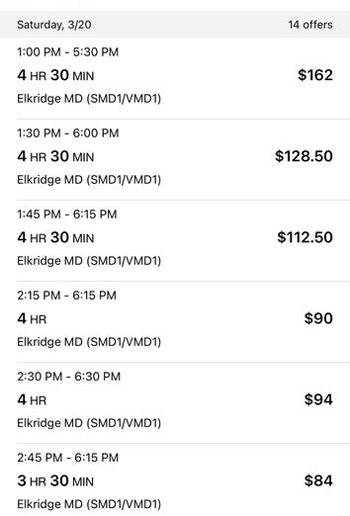

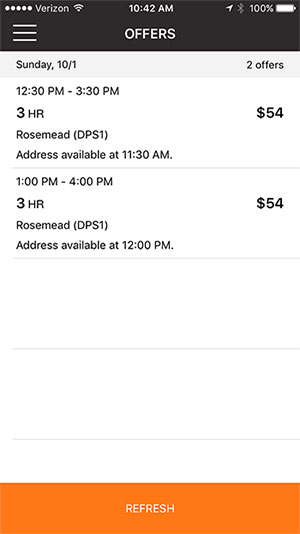

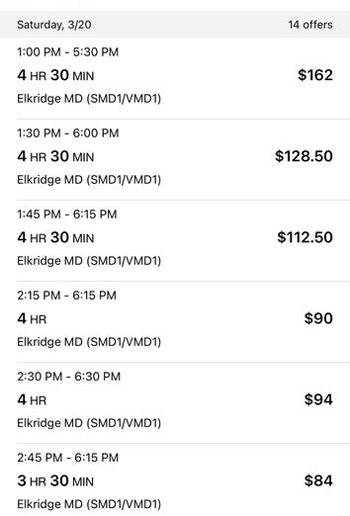

. Choose the blocks that fit your schedule then get back to living your life. Choose the blocks that fit your schedule then get back. You can plan your week by reserving blocks in advance or picking them each day based on your availability.

- Good Pay 25-35 an hour - Flexible Hours Choose any shift you want Cons. And heres something thats really important. Amazon Flex does not take out taxes.

Amazon Drive Cloud storage from Amazon. If you have a W-2 job and do Amazon Flex for extra money you can increase your withholding at your main job instead of paying quarterly taxes. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do.

Canada Fulfilment by Amazon FBA service fees are subject to Canadian sales tax at the tax rate of the fulfilment centre providing fulfilment services regardless of your business location. I would suggest downloading a tax application called hurdlr I use it for mileage and its awesome. If youre NOT simply the author or you were involved in publishing the book or whatever you were getting royalties from then its not as simple as that.

If youre an author and some other entity is the publisher then you commonly declare a royalty on the line for foreign income line 10400 for this years tax return. To make sure you do this right just look through your bank statements and add up your direct deposits from Amazon Flex. Gig Economy Masters Course.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and. The front page of the internet. AWS Canada is registered for Canadian Goods and Services Tax GSTHarmonized Sales Tax HST Quebec Sales Tax QST British Columbia Provincial Sales Tax BC PST Manitoba Retail Sales Tax MB RST and Saskatchewan Provincial Sales Tax SK PST.

The rates are currently 45p for the first 10000 miles of driving. As an independent contractor. Amazon Flex quartly tax payments.

If you dont have other tax withholding that covers your tax liability you will need to make quarterly tax payments. Increase Your Earnings. Whatever drives you get closer to your goals with Amazon Flex.

Amazon Flex is a program where independent contractors called delivery partners deliver Amazon orders. Amazon Advertising Find attract and engage customers. You pay 153 SE tax on 9235 of your Net Profit greater than 400.

All service fees for fulfillment by Amazon FBA in Canada regardless of location are subject to Canadian sales tax if any at the same tax rate as the fulfillment centerUnless its an official referral Amazon SoA and advertising fees are usually subject to personal income tax in the state where the seller lives. Youll need to record the number of miles you do keeping a detailed log of where you have travelled and then claim the set amount by HMRC. Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022.

With Amazon Flex you work only when you want to. If youre an Amazon seller living in the US then youre probably aware that tax time is coming up. Ontario 13 New Brunswick 15 Newfoundland 15 Nova Scotia 15 Prince Edward Island 15 When you make a sale on Amazonca the sale may be subject to GST HST or Provincial sales tax depending on whether you and the product you sell meet federal or provincial sales tax requirements.

Your 1099-NEC isnt the only tax form youll use to file. You may be required to collect GST HST or. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

Only available in limited areas these deliveries start near your current location and last from 15 to 45 minutes. Might make taxes more complicated. Adjust your work not your life.

Claiming for a Car on Amazon Flex Taxes. Driving for Amazon flex can be a good way to earn supplemental income. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare.

Fill out your Schedule C. We would like to show you a description here but the site wont allow us. We know how valuable your time is.

So you get social security credit for it when you retire. It automatically tracks milage and allows you to separate amazon flex miles business from personal in my case kilometers cause Im in Canada. Selling on Amazon SoA and advertising fees are typically subject to taxes where the seller is.

- More like a contract job. - Sometimes a shift will take longer than estimated. With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes.

Also hurdlr connects you within the proper tax bracket of whichever state or province you working out of. After October 1 2021 AWS Canada will issue tax compliant invoices for all. Amazon Music Stream millions of songs.

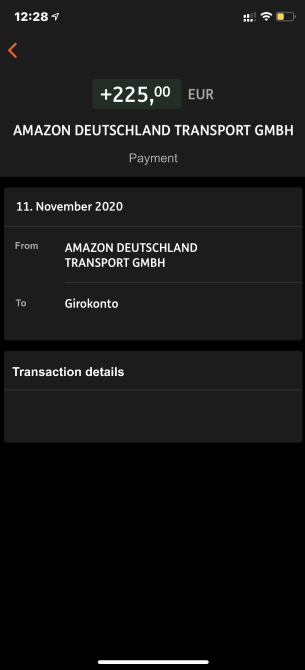

Amazon will not withhold taxes on the earnings of Canadian tax residents. Louis MO Boston MA Cincinnati OH Salt Lake City UT. Theres also Schedule C which shows Profit and Loss From Business.

Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on. If you are using your own car for Amazon then you can choose to claim an amount for the number of miles you drive. Turn on Location Settings.

Book Depository Books With Free Delivery Worldwide. Disable or uninstall any app that changes the lighting on your phone based on the time of day. Individuals C corporations sole proprietors single-member LLCs or LLCs taxed as corporations are required to file taxes by.

Amazon Flex drivers can make about 18 to 25 per hour. Online shopping for Tax Central from a great selection at Software Store. Amazon Web Services Scalable Cloud Computing Services.

With Amazon Flex you work only when you want to. You can plan your week by reserving blocks in advance or picking them each day based on your availability. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400.

Knowing your tax write offs can be a good way to keep that income in your pocket. New Brunswick 15 Newfoundland 15 Nova Scotia 15 Prince Edward Island 15 When you make a sale on Amazonca you may be required to register collect and remit GSTHST andor PSTRSTQST even if you do not have a physical presence in Canada or a particular province.

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Flex Filing Your Taxes Youtube

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

![]()

Does Amazon Flex Pay For Gas Mileage Rules How To Save Money

Amazonflex Amazon Flex Canada Pros Youtube

How To Do Taxes For Amazon Flex Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To Make Money On Amazon In Canada 12 Practical Ways 2022