pay ohio county taxes online

Mail to Ohio County Treasurer PO Box. You can pay online at treasurerfranklincountyohiogov Gross Real Estate Taxes for 2022 Tax Reduction Subtotal-Adjusted Tax Non-Business Credit Owner Occupancy Credit.

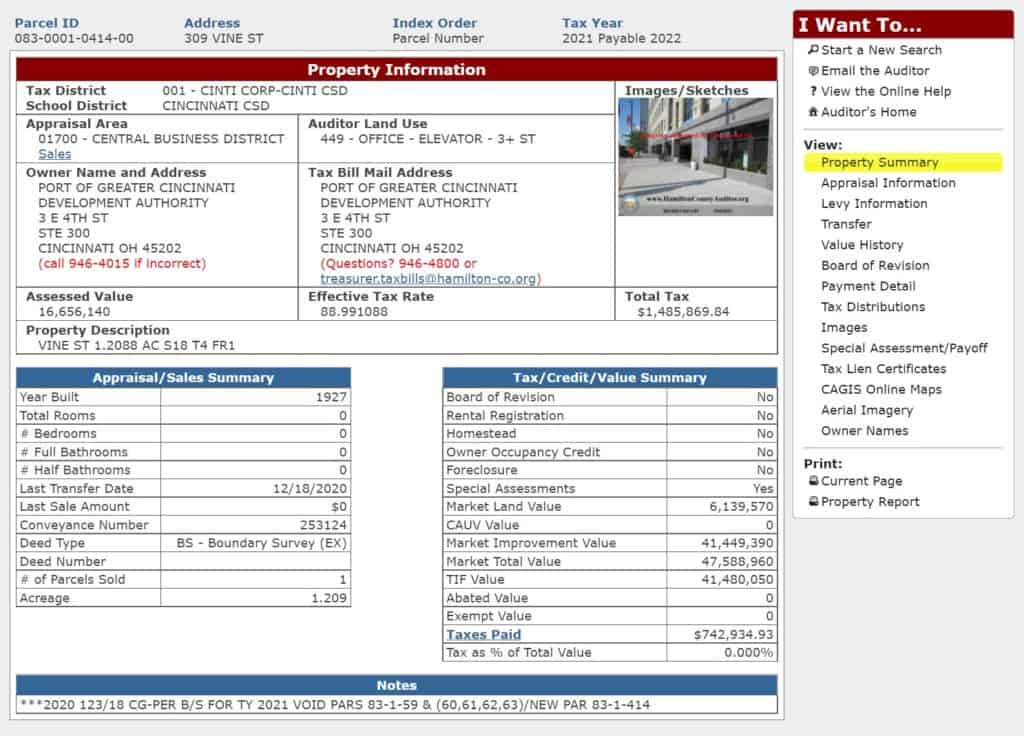

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

However the Treasurers Office has arranged alternative options to conveniently pay your taxbill by credit card.

. In addition to paying taxes through an installment payment plan there may be other options such as the Offer in Compromise OIC. Located at the County Administrative Headquarters 2079 E 9th. Please have your bill ready so necessary information can be found.

800 am - 500 pm Monday through Friday Phone. 800 am - 500 pm Monday through Friday Phone. Pay Your Jackson County Treasurer OH Tax Bill Online.

Must have tax payment coupon with you. 2022 Union County Ohio Government. You may pay your real estate taxes online subject to a convenience fee.

The following convenience fees will apply to online tax payments. Free Case Review Begin Online. After authorization of your payment you will be given a confirmation number that you should keep for your records.

105 South Market Street. St Cleveland OH for check or. Local Bank Branches such as Community Trust Bank Town Square Bank Kentucky Farmers Bank Citizens National Bank and Peoples Bank.

3 Full Time employees - 1 Chief Deputy and 2 Deputies. There will be a nominal fee. Debit Card - 395 one time charge E-Check - 150 one time charge To make a payment online first click HERE to go to Ascent.

Make a debitcredit or eCheck payment online. Eastern time on the due date. No Credit Card payments will be accepted by mail.

Any payments made after 800 PM. For creditdebit payments a convenience fee will apply see below. Online using this website using the Pay Online tab at the top of the page.

Please visit the Point and Pay website or select the link button below for payment and convenience fee details. Search Pay Online SEARCH BY ACCOUNT NUMBER PARCEL ID NAME ADDRESS. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

We researched it for you. Online Tax Record Search Enter a search argument and select the search button Pay your taxes online Enter Taxpayer Name last first. Just follow the simple steps outlined at their website.

I promise to provide professional oversight over our investments and exercise professional judgement with a service attitude in the administration of my statutory duty as County Treasurer. The IRS is not. You can use the return envelope.

To pay online through Point Pay click here. Our office is open Monday Friday 800 am. Welcome to the Cuyahoga County Treasury Website.

Home Departments Treasurer Pay Taxes by Credit Card E-Check. Annual general fund budget just under 200K. Online Property Tax Payment Enter a search argument and select the search button.

Lake County Ohio. 105 Main Street Painesville OH 44077 1-800-899-5253. Enter Tax Year and Ticket Number and suffix.

Franklin County Ohio Real Estate Taxes for 2nd Half 2021 Due Date 6212022 Office Hours. Yes you can opt to pay your tax liability through an installment plan. We recommend excluding any dashes or.

Credit Card - 23 of your total payment. To pay by credit card or debit card using a touch-tone telephone call the toll-free number 1-800-2PAY-TAX 1-800-272-9829. Collect nearly 120.

Ohio County Sheriffs Tax Office 1500 Chapline St. Point Pay charges 100 per electronic check payment. Ohio County Sheriffs Tax Office 1500 Chapline St.

Enter Taxpayer Account Number. Enter Tax Year and Ticket Number and suffix. Skip to Sidebar Nav.

This fee is in no way charged by the Hamilton County Treasurers Office. 187 Rising Sun IN 47040. Call 1-800-272-9829 to pay by creditdebit card Drop Box.

Based On Circumstances You May Already Qualify For Tax Relief. Duties of the County Treasurer. You will have to search by your name property address or parcel number and then from the select detail.

Enter Ohios Business Tax Jurisdiction Code 6447 when prompted and follow the recorded instructions. Mail your check or money order and the bottom portion of your tax bill. Enter Taxpayer Name last first.

Find Out What You Need To Know - See for Yourself Now. Point and Pay is authorized by the Union County Treasurer to accept online real estate tax payments. In our office at 1700 Greenup Avenue.

Box 188 Wheeling WV 26003 304 234-3688. Ad Find Reviews Prices Numbers And Addresses For The Top 10 Voted. Box 188 Wheeling WV 26003 304 234-3688.

You can locate any property in our database by entering your search in the box above. 911 Communications Animal Shelter - Dog Warden Development Authority Elections Voting Emergency Management Emergency Medical Services Finance and Accounting Wheeling - Ohio County Airport Flood Plain Management WVU Extension More. Ad Is Your Access Ohio Bill Due Soon.

EASY PAYMENTS VIA PHONE INTERNET OR THE OHIO BUSINESS GATEWAY. Under an OIC agreement the IRS may agree to settle the taxpayers liability for less than the full amount of taxes owed. You may pay online at treasurerfranklincountyohiogov Gross Real Estate Taxes for 2021 Tax Reduction Subtotal-Adjusted Tax Non-Business Credit 76885.

Find a Bill SEARCH BY ACCOUNT NUMBER PARCEL ID NAME ADDRESS. You have the following options to pay property taxes in Columbiana County. Ad See If You Qualify For IRS Fresh Start Program.

To 500 pm except holidays. Penalties and interest will be incurred after 800 PM. You can pay your property taxes in-person during those hours using cash personal check creditdebit card or a verified payment cashiers check or money order.

Franklin County Ohio Monthly Real Estate Tax Pre-Payment Notice Due Date 8222022 Office Hours. Httpspaypaygovus Look up by name parcel number or address. Has to be postmarked before due date anything postmarked after due date will be subject to late.

For creditdebit card or eCheck payment by phone call 1-866-288-9803. Eastern time will be processed on the next days date. Pay by e-check or creditdebit card.

Call 877 495-2729 Or pay online by clicking the link below. Staff members are available to take your payment from Monday-Friday - 800 am to 400 pm Except holidays at the Columbiana County Treasurers Office located at. Pay Online Please allow three 3 business days to post.

Apply For Tax Forgiveness and get help through the process. Enter Taxpayer Account Number. Pay Your Bill Securely with doxo.

Former Bar With Rental Space Online Auction 2853 Lagrange Street Toledo Ohio 43608 Bidding Ends Tuesday June Commercial Property Public Restroom Ohio

Pay Online Department Of Taxation

Ohio Sales Tax Small Business Guide Truic

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Ohio Tax Forms 2021 Printable State Ohio It 1040 Form And It 1040 Instructions

Real Estate Blog Mortgage Payment Property Tax Florida Real Estate

Pay Online Department Of Taxation

Ohio Sales Tax Guide For Businesses

Welcome To Ohio Telefile Sales And Use Tax Department Of Taxation

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Duplex In West Toledo Online Auction At 1336 Craigwood Toledo Oh 43612 Bidding Ends August 23 2018 At Real Estate Auction Residential Real Estate Ohio

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

Ohio Estate Tax Everything You Need To Know Smartasset

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Income General Information Department Of Taxation

Find Tax Help Cuyahoga County Department Of Consumer Affairs